If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

IN TODAY’S REPORT

⚡ROUNDUP

Key headlines shaping the auto industry this week

⚠️ Recalls & Safety

💰 Financials & Corporate Strategy

Rivian widens Q3 loss despite growing software revenue from VW (Link)

Rivian starts earning software revenue with Volkswagen as its main customer (Link)

Porsche opens China R&D center to accelerate localized innovation (Link)

Toyota and Honda pivot to India as new global production hub, reducing China reliance (Link)

🔋 Batteries & Electrification

🤖 Autonomy & Chips

XPeng teams up with Alibaba’s Amap to launch robotaxi service in China (Link)

XPeng to roll out 5-, 6-, and 7-seat robotaxis in 2026 (Link)

XPeng’s NGP system goes head-to-head with Tesla’s FSD in real-world testing (Link)

Aurora extends driverless freight network to El Paso (Link)

Volkswagen to develop its own assisted driving chip in China (Link)

Volkswagen invests $200 million in in-house SoC development in China (Link)

VW confirms in-house SoC initiative for autonomous and smart vehicles (Link)

ZF and Horizon Robotics to jointly launch advanced driver-assistance system for China (Link)

Chinese state firms launch car-chip testing platform amid Nexperia tensions (Link)

🧠 AI, Software & Mapping

🚗 Models, Launches & Spy Shots

💼BRIEFING

Top insights and analysis that is moving the needle in the automotive industry

Many Western automotive journalists still joke that BYD Auto is “just a Chinese car company” and can’t match Western brands—even though BYD now leads global plug-in vehicle sales.

BYD reportedly has over 100,000 engineers, making its R&D workforce possibly the largest of any automaker.

Test drives of BYD models (e.g., the Seal or Seagull) demonstrate high build quality, tech richness, and driving experience that challenge longstanding perceptions.

Porsche inaugurated its first strategic R&D centre outside Germany in Shanghai’s Jiading district, integrating R&D, procurement and quality control under one roof.

The centre’s first deliverable: a China-specific infotainment system scheduled for rollout in Porsche vehicles in 2026.

Why it matters: A luxury OEM putting major innovation hub in China signals that China is not just a big market but a critical innovation engine. In a way, they are also signalling that the innovation pace at Europe is not enough. Not only that the pace is slow, but it is almost impossible to get that pace even if they allocate more CapEx to it.

The Chinese government and state-owned enterprises have launched a state-level automotive chip testing platform in Shenzhen equipped with over 80 test rigs and 13 labs covering high-end automotive-grade chips.

The platform supports localisation of high-end automotive semiconductors and aligns with China’s push for “technological self-reliance” amidst global export/geo-political tensions (e.g., issues with Nexperia).

Why it matters: Car chips are a strategic supply-chain node. This initiative shows how China is reinforcing its ecosystem with implications for global OEM sourcing, standard-setting and risk management. It will be interesting to see how global automakers respond (e.g., diversifying supply).

Toyota Motor Corporation, Honda Motor Co., Ltd. and other global automakers are increasing investment in India to build export-oriented production bases, reducing reliance on China.

India offers cost advantages, a growing ecosystem and growing export appeal — making it an increasingly attractive manufacturing hub.

XPENG Inc.’s NGP (Navigation Guided Pilot) system, which competes with Tesla’s FSD, is included even in its entry-level models (~¥119,000 ≈ US$17k) — while Tesla charges ~$10k extra for FSD.

The test drive emphasised the difference in cost structure and software availability, suggesting Chinese OEMs are pushing advanced ADAS/AV features aggressively.

Rivian Automotive, Inc.’s Q3 software division saw a 324% growth to US$416 million, with over US$214 million coming from a partnership with Volkswagen Group.

This is a strong signal that software-defined vehicles are not far off and that revenue from technology/licensing is becoming material for EV makers.

Why it matters: The irony is that VW has not yet started to make money form this endeavor.

ZF Friedrichshafen AG and Horizon Robotics are teaming up to launch a Level-3 ADAS system in China, planned for 2026, featuring >1,000 TOPS compute and advanced sensor stacks.

Reflects how global Tier-1 suppliers are localising high-end driver assistance / autonomy tech for the China market.

XPENG announced plans to deploy 5-, 6- and 7-seat robotaxis in China starting 2026, further emphasizing its ambitions in shared mobility and autonomy.

The focus expands beyond personal ownership to mobility services and robotaxi platforms.

Why it matters: Mobility models are evolving and the auto business is not just about selling cars but offering mobility as a service and software-/platform-oriented offerings.

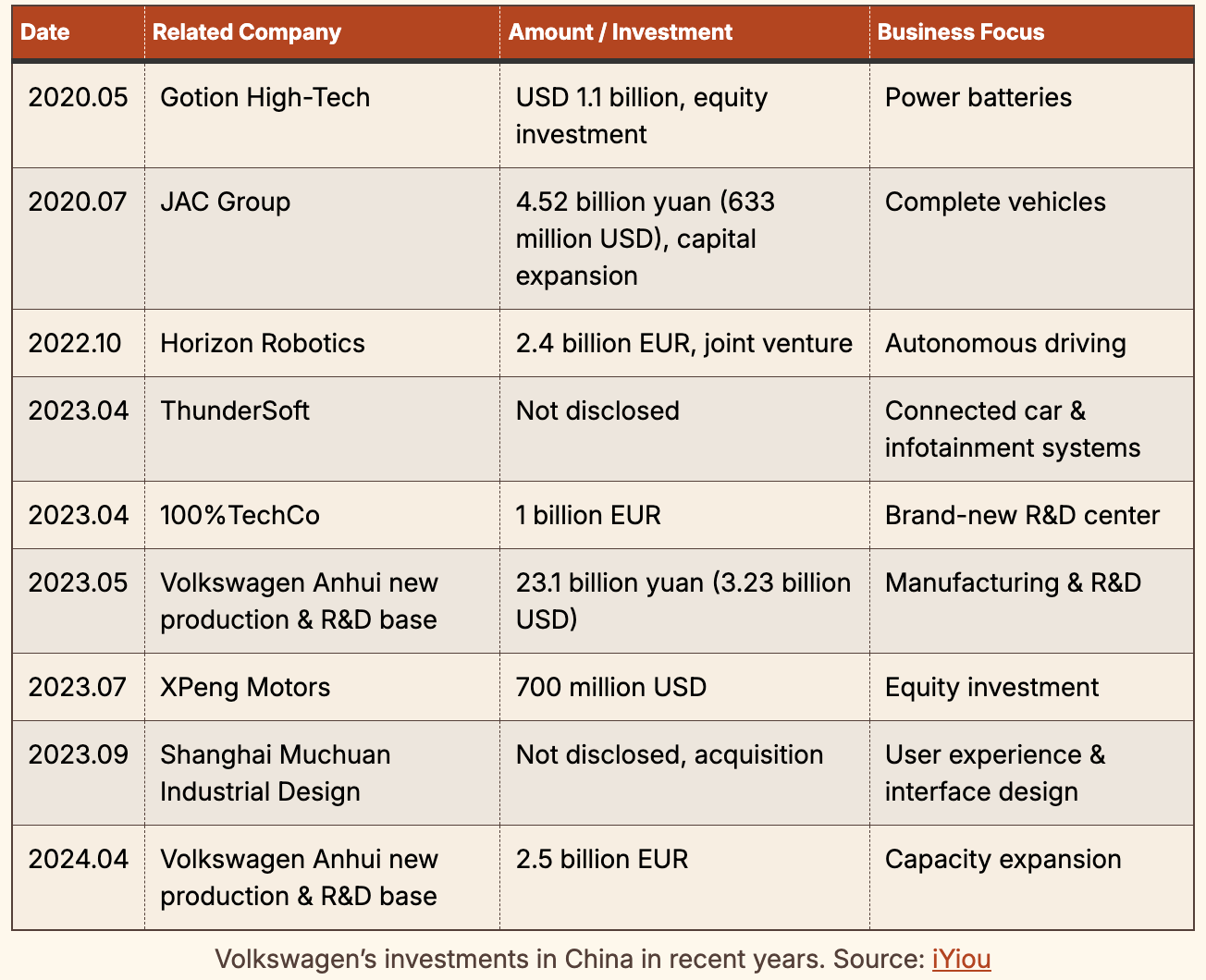

Volkswagen has committed US$200 million to develop in-house System-on-Chip (SoC) capabilities in China, supported by its subsidiary Cariad and Chinese partner Horizon Robotics.

The target compute power: 500-700 TOPS for advanced driving systems with mass production expected within 3-5 years.

The move aligns with the trend of OEMs taking more control over core electronics, especially in the EV era.

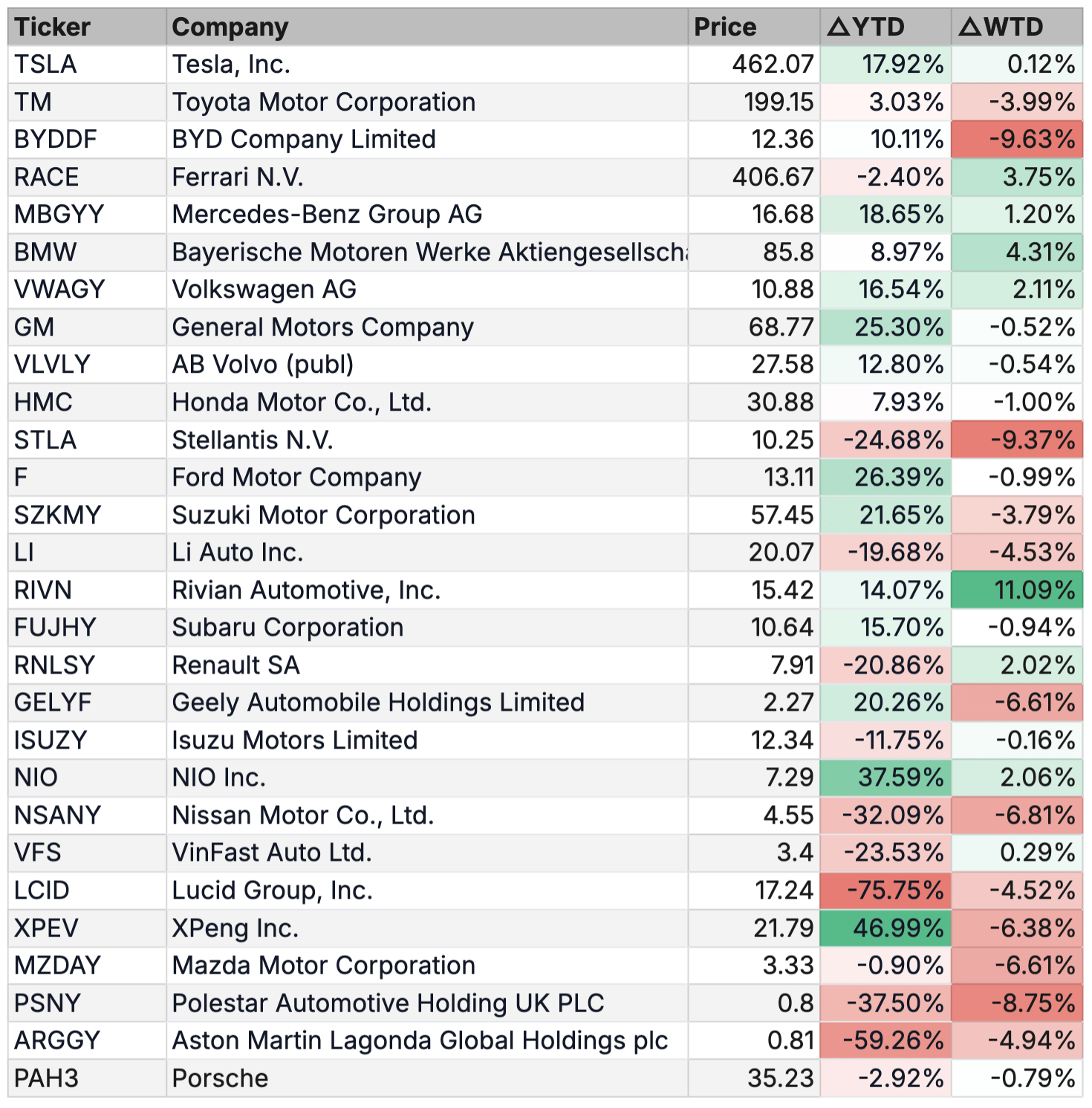

📈MARKET SNAPSHOT

This week’s key movers in the automotive stock market

🐦AUTO BUZZ

Top posts, tweets, and videos from the automotive industry

💹FINANCIALS

A focused look at recent automotive company financials

Ferrari Q3

Financial performance overview

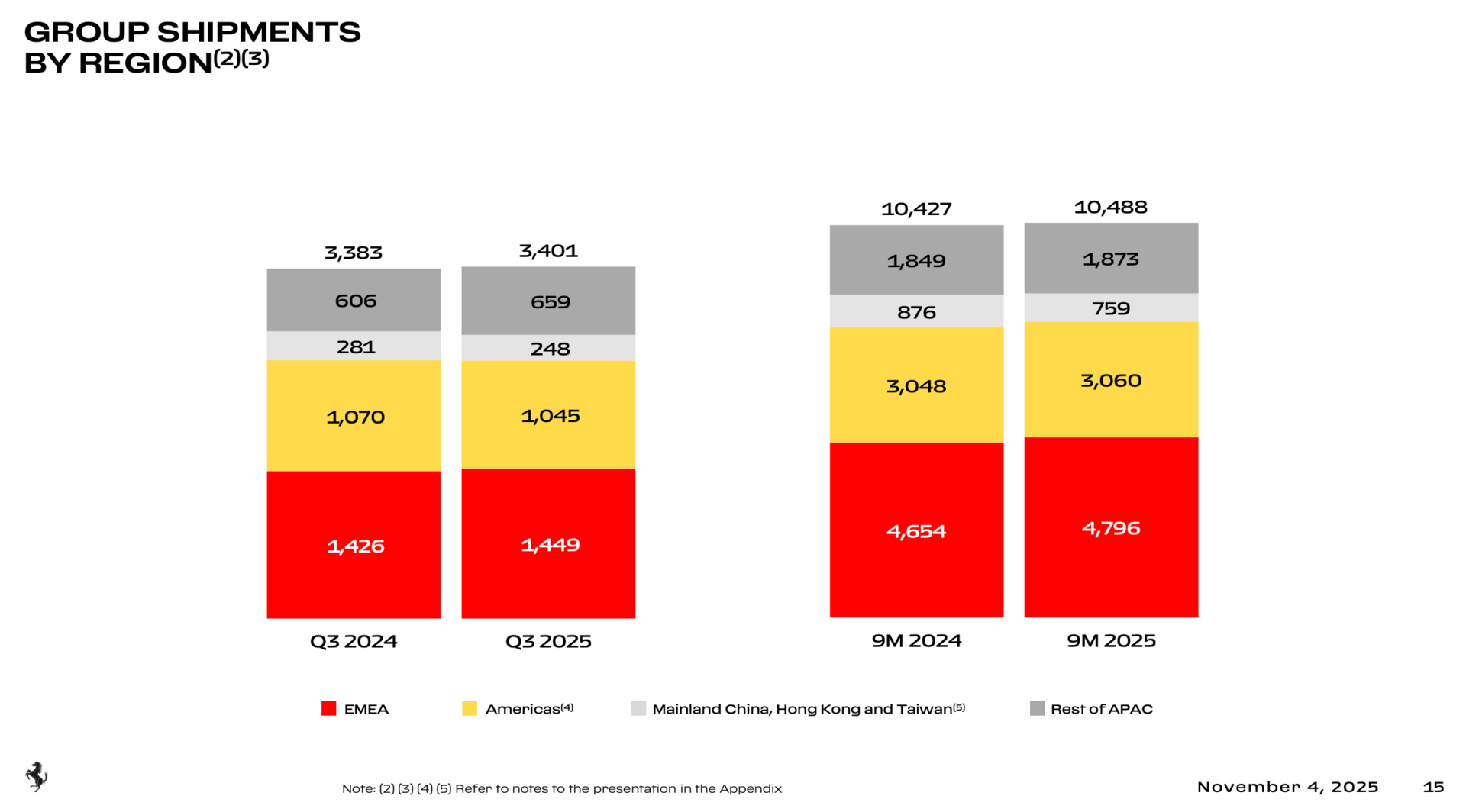

Ferrari delivered strong Q3 2025 results with net revenues of €1,766 million, up 7.4% year-over-year (9.3% at constant currency), despite shipments remaining substantially flat at 3,401 units. Operating profit (EBIT) reached €503 million, up 7.6% with a margin of 28.4%, while EBITDA was €670 million with a 37.9% margin. Industrial free cash flow generation was strong at €365 million.

The revenue growth was primarily driven by richer product mix and increased personalizations, which accounted for approximately 20% of total revenues from cars and spare parts, particularly relevant for the SF90 XX family and the Purosangue. Diluted EPS was €2.14, up 2.9% from Q3 2024.

Technical details and product developments

Powertrain strategy recalibration

Ferrari announced a significant strategic shift in its powertrain mix for 2030. The company revised its original 2022 plan from 20% ICE, 40% hybrid, and 40% electric to 40% ICE, 40% hybrid, and 20% electric.

Infrastructure developments

• E-building facility: New manufacturing facility in Maranello capable of producing all three powertrains (ICE, hybrid, and electric)

• New paint shop: Under construction, with capital expenditures focused on this project

• E-Vortex test circuit (completed October 6, 2025): New infrastructure adjacent to the Fiorano track, approximately two kilometers long covering 37,000 square meters, for functional testing of sports cars fresh off the production line

Order book and demand

The order book extends well into 2027, driven by strong reception of the Amalfi and 849 Testarossa family. Demand for new models remains robust, with strong order intake and high interest from new clients, especially for the Amalfi.

Geographic performance and US market

Q3 shipments by region showed EMEA up 23 units, Americas down 25 units, Greater China down 33 units, and Rest of APAC up 53 units.

Regarding US tariff impacts, management confirmed that business in the US “proceeds as usual.” Tariffs were reduced from 25% to 15%, and Ferrari updated its commercial policy accordingly—price increases are now capped at 5% (previously up to 10% when tariffs were at 25%).

Personalizations

Personalizations remain a key driver, with Q3 penetration at approximately 20%, stronger than the long-term target of 19%. The new tailor-made centers are primarily designed to bring Ferrari closer to clients in markets where personalization is particularly relevant, such as Japan and the Western Coast of the USA.

Capital allocation

Ferrari is nearing completion of its multi-year share repurchase program of approximately €2 billion, one year ahead of the original schedule. The company repurchased €132 million worth of shares in Q3 2025. Net industrial debt stood at €116 million at quarter end, with total available liquidity at €1,968 million including undrawn committed credit lines of €550 million.

Rivian Q3

Financial performance overview

Rivian delivered strong Q3 2025 results with consolidated revenues of $1,558 million, up 78% year-over-year. The company achieved a significant milestone by generating $24 million in consolidated gross profit, a $416 million improvement from the $(392) million loss in Q3 2024. This marked a gross margin improvement to 2% from (45)% in the prior year.

The company delivered 13,201 vehicles and produced 10,720 vehicles during the quarter, representing the highest quarterly deliveries for the year.

Rivian reaffirmed its full-year 2025 delivery guidance of 41,500 to 43,500 vehicles.

Margins and cost performance

Automotive segment

Automotive gross profit loss narrowed to $(130) million in Q3 2025, a $249 million improvement year-over-year. This improvement came despite headwinds from low fixed cost absorption associated with planned shutdown to prepare the Normal plant for R2 production.

Software and services segment

Software and services achieved strong performance with $416 million in revenue (up 324% year-over-year) and $154 million in gross profit, representing a 37% gross margin. About half of this revenue was from the Volkswagen joint venture for software and electrical hardware development services.

Volkswagen partnership - detailed analysis

Financial structure

The Volkswagen partnership represents one of the most significant strategic relationships for Rivian. Volkswagen made an initial equity investment of $1.0 billion in June 2025, consisting of an unsecured convertible note that converted into shares of Rivian’s Class A common stock. On June 30, 2025, Rivian received the first additional equity investment tranche of $1.0 billion in exchange for $750 million of Class A common stock, issuing approximately 52 million shares at $14.56 per share.

Rivian continues to expect to receive up to an additional $2.5 billion from Volkswagen Group, comprised of $1.5 billion in equity investments (which may be effected in part with a convertible debt instrument) and $1.0 billion in the form of a loan through the joint venture. The company expects $2.0 billion of this capital to be received in 2026.

Operational progress

Scaringe emphasized the strong relationship with Volkswagen Group, noting he was in Munich a few months ago for product reveals, including the Volkswagen ID.1, a roughly $22,000 EV being developed by Volkswagen leveraging Rivian’s technology platform. He described it as “just an awesome vehicle” and the first of many programs to emerge from the collaboration.

Overall strategy and technology

Powertrain strategy

Rivian is not planning to offer an extended-range electric vehicle (EREV) or hybrid that would involve putting an engine into vehicles. Scaringe stated, “We’re very focused on continuing to lead with electrification. We think particularly for the midsized segment SUV, which is going to make up the vast majority of our volume with the launch of R2 and then its follow-on product with R3, that segment really works beautifully with a fully electric architecture, where we’re able to deliver great performance, outstanding range and at a price point that’s very comparable to ICE or hybrid alternatives.”

Autonomy and AI

Rivian announced it will host an Autonomy and AI Day on December 11, 2025, where it will share more details on the company’s autonomy vision and technology roadmap.

The Rivian Autonomy Platform has been designed around an end-to-end AI-centric approach. Recent updates in Q3 provided expansion of hands-free capabilities on the highway for second-generation R1 vehicles, contributing to a 70% increase in miles driven using the feature.

Scaringe explained the long-term differentiation: “Over the longer term, we believe what will differentiate Rivian’s autonomous capabilities will be our end-to-end AI-centric approach. With the launch of R2, our growing fleet of customer vehicles will collect real-world driving data, which will complement the data already collected by our second-generation R1 vehicles. That data can be used to train our large driving model which we believe will allow a rapid rollout of updating driving inference models with growing capabilities.”

Vertical integration philosophy

Scaringe emphasized that Rivian’s competitive advantage stems from product and brand differentiation through vertically integrated technologies and direct-to-customer sales and service model. These technologies include the zonal network architecture and associated in-vehicle electronic control units, full vehicle software stack, in-house autonomy platform, and propulsion platform.

R&D investments

R&D expenses in Q3 2025 were $453 million, compared to $350 million in Q3 2024. The increase was primarily due to higher engineering, design, and development costs surrounding the R2 platform, higher software costs supporting new in-vehicle technologies including the autonomy platform, and higher stock-based compensation expenses.