Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

IN TODAY’S REPORT

⚡ROUNDUP

Key headlines shaping the auto industry this week

⚙️ Corporate & Strategy

Elon Musk admits legacy automakers “don’t want” to license Tesla’s Full Self-Driving tech (Link)

GM’s internal software division faces another leadership shakeup amid restructuring (Link)

Volkswagen’s volume brands form a regional production network to streamline operations (Link)

Volkswagen opens its most comprehensive R&D hub outside Germany — in mainland China (Link)

VW also unveils its first full-process R&D and testing center in China (Link)

CATL and Stellantis break ground on a €4.1B gigafactory in Spain (Link)

China’s Jiangxi to gain 3 GWh of solid-state battery capacity from two major projects (Link)

China forecasts auto exports surpassing 6.8 million vehicles in 2025 (Link)

🚗 Products, Launches & Model News

China-only Ford Mondeo launches December 4, featuring a 27-inch 4K display (Link)

BYD Ti7 plug-in hybrid SUV debuts in Thailand as the brand’s new global model (Link)

Mazda Vision X Compact previews the next-generation Mazda2 (Link)

2026 Mazda CX-5 gets Google built-in and Gemini integration for an upgraded cockpit (Link)

Audi brings back physical steering wheel buttons for its 2026 lineup (Link)

Tata Sierra’s new ARGOS platform detailed — designed for scalability and electrification (Link)

Audi adds new hardware and software upgrades across A5, Q5, A6, and e-tron models (Link)

🔋 Batteries, Charging & Electrification

🤖 Software, AI & Connectivity

Rivian rolls out a new autonomy update ahead of its December product event (Link)

XPeng upgrades G7 and P7 with third in-house developed AI chip (Link)

Rivian–VW joint venture adopts Amazon technology for real-time video protection and telemetry (Link)

Li Auto launches AI-powered glasses to enhance in-car experience (Link)

Beyless achieves ASPICE CL2 certification for in-vehicle software quality standards (Link)

Audi joins the in-car streaming trend, partnering with Disney for infotainment video access (Link)

⚠️ Recalls & Quality Control

📉 Market Trends & Commentary

Tesla sales drop globally amid rising competition from Chinese and legacy OEMs (Link)

InsideEVs explores how XPeng and Tesla are using AI-driven robots to improve factory efficiency (Link)

WardsAuto examines how Hydrahertz and thermal innovations could reshape EV battery design (Link)

Electric-Vehicles dives into Rivian–VW–Amazon collaboration and its implications for connected mobility (Link)

AutotechInsight looks at how Li Auto’s new AI wearables could redefine cabin experiences (Link)

💼BRIEFING

Top news that is moving the needle in the automotive industry

BYD’s 5-Minute “Flash Charging” Heads to Europe/UK 🚗⚡

BYD is rolling out its “Flash Charging” system, ultra-fast chargers capable of up to 1,000 kW (1 megawatt).

On compatible EVs, that enables going from low battery to 50 %+ in under five minutes.

BYD is actively hiring staff in Europe to build and manage a Flash-charger network, indicating deployment is planned soon.

According to statements, the first Flash-charging stations could arrive in the UK around 2026, with an aim of installing 300 ultra-fast chargers before the end of next year.

The charging infrastructure will be based on BYD’s in-house Super e-Platform, a 1,000-volt electrical architecture. Currently, models like Han L and Tang L use this platform but none of BYD’s cars on sale today in Europe meet the requirements yet.

BYD says that while the chargers are open to all EV brands, only vehicles built on the Super e-Platform will reap the full benefits of megawatt charging speeds. Other EVs would be limited by their own charging capabilities

China to Export ~6.8 Million Cars in 2025 🚗🌍

China’s auto industry expects over 6.8 million vehicle exports in 2025.

Export volumes have surged in recent years: 5.86 M in 2024, 4.91 M in 2023, 3.11 M in 2022.

In the first 10 months of 2025, exports already hit 5.62 million, up 15.7% YoY.

Export value for that period reached 798.39 billion yuan (~$112.8B), a 14.3% increase.

Domestic vehicle production for Jan–Oct 2025 totaled 27.7 million units, up 13.2% YoY.

CAAM forecasts total 2025 vehicle sales to exceed 34 million, with 16 million NEVs included.

Rivian–Volkswagen JV Adopts Amazon Tech for Real-Time Vehicle Video Protection

The Rivian–Volkswagen Group Technologies joint venture is integrating Amazon Web Services (AWS) to enable real-time video streaming for vehicle security.

The system uses Amazon Kinesis Video Streams with WebRTC, allowing owners to view live camera footage on their phones with under-1-second latency when an alert is triggered.

This upgrades Rivian’s original “Gear Guard” system, which relied on local storage and on-vehicle AI — now owners get instant, live access without waiting for saved clips.

Importantly, no video is permanently stored on AWS or Rivian servers, maintaining strong privacy protections.

The technology will debut on the upcoming Rivian R2, followed by future EVs from Volkswagen Group brands such as Volkswagen, Audi, and Scout.

In-Car Video Streaming Is Taking Off — Audi Joins In With Disney+

Audi is integrating Disney+ directly into its vehicles, available through the built-in Audi Application Store.

Streaming works on the center display when parked, or on the front passenger screen while driving, with no phone required.

The rollout spans 43 global markets and includes models such as the A5, Q5, A6, A6 e-tron, and Q6 e-tron.

Consumer demand is rising: surveys show nearly half of buyers now consider in-car video entertainment an important factor when choosing a vehicle.

Automakers see this as a path to new revenue streams, using native software environments to offer entertainment, content partnerships, or even advertising.

🔍 ANALYSIS

Deeper look at the larger trends

Elon Musk says legacy automakers don’t want FSD, and strategically they’re right

Elon Musk recently reiterated something he has been hinting at for years: Tesla has offered FSD to other automakers, and they simply don’t want it. At first glance, this seems counter-intuitive. Why wouldn’t legacy OEMs want access to the most advanced consumer autonomy system on the market? But when you examine the incentives, the platform dynamics and the structural consequences of integrating FSD, the refusal becomes not just understandable but inevitable.

The core issue is that FSD is not a component. It is a platform. And platform owners have disproportionate power. If an automaker were to adopt Tesla’s autonomy stack, Tesla would control the roadmap, the pacing of updates and the distribution of new capabilities. Tesla could release the latest features to its own vehicles first, leaving licensed versions perpetually behind. The asymmetry is baked into the structure. No OEM wants to be locked into a competitor’s stack that guarantees permanent second-tier performance.

There’s also the question of feature access itself. Tesla could simply decide that certain capabilities are proprietary. A brand licensing FSD would never have visibility into what’s being withheld. Tesla would always own the “best” version, licensees get whatever subset Tesla deems strategically acceptable. That creates a deep disadvantage for any OEM trying to differentiate on software or driver-assistance sophistication.

FSD cannot simply be bolted onto an existing vehicle platform. OEMs would have to redesign large swaths of their architecture (sensor configuration, compute layout, software pipelines, OTA integration, data interfaces, safety redundancy) to accommodate Tesla’s system. That means significant upfront cost. More importantly, it creates lock-in. Once an automaker has reshaped its architecture around FSD, and once its customers have experienced that system, the company cannot switch away without alienating its user base and rebuilding core technology from scratch. At that point, Tesla effectively becomes the OEM’s operating system provider. The dependency becomes structural and irreversible.

The economics tilt even further toward Tesla. FSD licensing would become a high-margin revenue stream. Tesla would earn recurring revenue from every competitor using its tech. Meanwhile, the OEM would be forced to push that cost downstream to customers. Tesla can hide its autonomy costs inside the vehicle price, or even bundle it, while licensees must charge a premium. The result is a distorted market where Tesla offers superior autonomy at a lower effective price and still gets paid by rivals selling their own inferior version. This is the definition of leverage.

Then there’s the deeper strategic risk. Autonomy is not just another feature. It is the future profit pool of the industry. Handing that layer to Tesla would be equivalent to delegating the company’s future competitive edge. It is analogous to Apple asking Samsung to run iOS, or Google asking Meta to distribute Google Play. Any dependency at that level becomes an existential vulnerability.

Given these dynamics, the decision becomes obvious. Tesla offering FSD makes perfect sense for Tesla. It extends its platform, diversifies revenue and strengthens its competitive moat. But for every other automaker, the long-term consequences are unacceptable.

Volkswagen unveils first full-process R&D and testing centre outside Germany in China (Link)

Volkswagen’s decision to open its first full-process R&D and testing center outside Germany is not simply an operational adjustment. It is an admission that the old model of global automotive development is collapsing. The assumption that a centralized engineering hub in Europe could design vehicles for every market has been eroding for years, but China’s acceleration in EVs, software and consumer expectations has pushed that logic to its breaking point.

The cultural dimension is the first and most important shift. German automakers have long struggled with China not because they lacked interest, but because they lacked immersion. The Chinese market doesn’t just speak a different language; it operates under a different logic. Consumer expectations move faster. Software norms differ. The ecosystem is aggressively competitive. And the pace of iteration is measured in weeks, not years. For a German company accustomed to deliberate engineering cadence and centralized hierarchy, trying to understand China from Wolfsburg is like trying to understand Shenzhen from a PowerPoint deck. You may be aware of what is happening in theory, but you will always be late in practice.

By embedding an end-to-end R&D center inside China, Volkswagen is doing something structurally necessary: eliminating the translation gap. You cannot learn a market’s instincts from quarterly reports. You have to be inside the cultural environment, responding to real users and real competitors. This is particularly true in China, where “what happens in China stays in China” is less a cliché than a structural truth. The country’s semi-closed internet ecosystem, its domestic app stack, and the state-controlled media environment mean that the external view of Chinese mobility trends is perpetually incomplete. You cannot observe China from Europe; you can only observe China from China.

Layered onto this is geopolitics. Export controls and U.S.-China tensions are forcing global companies to rethink the assumption that intellectual property can freely move across borders. When a German OEM works on cutting-edge EV software or power electronics, it cannot simply shuttle those innovations back and forth between continents without triggering regulatory risk.

Cost adds another structural pressure. Developing China-specific solutions in Europe is simply too expensive. European engineering talent is high-cost, R&D burdens are rising, and the EV transition has stretched budgets thin. Asking a German team to build Chinese-market software and HMI layers is wasteful. In contrast, China offers scale: more engineers, faster cycles, significantly lower labor cost and a vendor ecosystem that can deliver prototypes in a week, not six months.

And then there is the uncomfortable truth: the definition of “state of the art” has fragmented. In the early 2010s, German engineering represented the pinnacle. Today, the Chinese market sets the pace in electric powertrain integration, in-car UX, ADAS deployment speed and even platform modularity. A global automaker can no longer assume that its core R&D center sits at the top of the technological pyramid. Volkswagen’s new China center is a recognition that to be competitive in China, you need an R&D organization that is ahead specifically for China.

If the twentieth century belonged to German automotive engineering, the twenty-first will be defined by whoever learns fastest. Volkswagen’s new China R&D center isn’t about expanding capacity. It’s about survival in a world where the center of gravity has moved.

Xpeng’s Third In-House Chip and the Logic of Full-Stack Autonomy

Xpeng’s decision to upgrade its G7 and P7 models with a third in-house developed chip represents something important: the company is committing to the same kind of full-stack technological stack ownership that has defined Tesla’s long-term advantage. And in doing so, Xpeng is implicitly making a bet about where value will accumulate in the next decade of the automotive industry: not in the metal, not in the powertrain, but in the silicon and the software layers that sit directly on top of it being the key differentiator.

The first question this raises is feasibility. Developing a custom chip is not a weekend project. It requires talent, capital, a reliable chip design house, a chip fabricating partner, a stable long-term roadmap and sufficient production volume to justify the investment. Historically, this is why automakers have relied on suppliers like NVIDIA or Qualcomm. But Xpeng appears to be reaching the threshold where the economics flip. If a vehicle now carries three high-performance chips, and if the company plans to ship hundreds of thousands of vehicles per year in the future (including both Xpeng and VW volumes), the amortization curve begins to work in its favor.

This isn’t just about spreading cost over units. Every generation of in-house silicon lowers marginal cost. Designing becomes easier. Manufacturing partners optimize the node for your workloads. The internal software team becomes more fluent in the architecture. The toolchain becomes more stable. And the performance-per-dollar improves faster than if you rely on a general-purpose provider. This is the pattern Tesla demonstrated: the first generation was expensive; the second generation worked; the third became a weapon.

And that gets to the deeper strategic point. Purpose-built chips will eventually beat NVIDIA’s general-purpose silicon for the same reason Apple’s M-series chips run circles around generic laptop processors, and Google’s TPUs have a lower cost for LLM training and inference. A chip optimized for a specific problem domain will outperform a GPU originally designed for gaming and repurposed for AI. NVIDIA’s advantage is CUDA, the ecosystem. But an automaker that is serious enough can build the tooling, compilers and frameworks it needs. The cost is high upfront, but the reward is control. Once you reach that level of investment, NVIDIA becomes not a partner but a bottleneck.

Interestingly, Xpeng’s current generation still includes a Qualcomm chip in the stack, a reminder that autonomy is not just one chip but a constellation of compute tasks. But that Qualcomm chip isn’t cheap. And depending on it means pricing, supply, integration and performance constraints that sit outside Xpeng’s control. Replacing it, eventually, is not about saving money; it’s about eliminating strategic fragility. This is exactly the same logic behind Tesla’s Hardware 3, 4 and soon Hardware 5: build what you need, own the entire chain, remove dependency wherever possible.

There is also a broader incentive hiding underneath the surface: licensing. If Xpeng’s in-house silicon matures into a stable, high-performance, automotive-grade platform, it becomes a product in its own right. And the most obvious customer is Volkswagen via its joint venture. VW has volume, global reach and a desperate need for a viable software and autonomy stack. Xpeng selling them the platform specifically built in for the Chinese market becomes a viable option. And in that scenario, building in-house chips is not overkill. It becomes the foundation for a new line of semiconductor business and for a multi-billion-dollar licensing business.

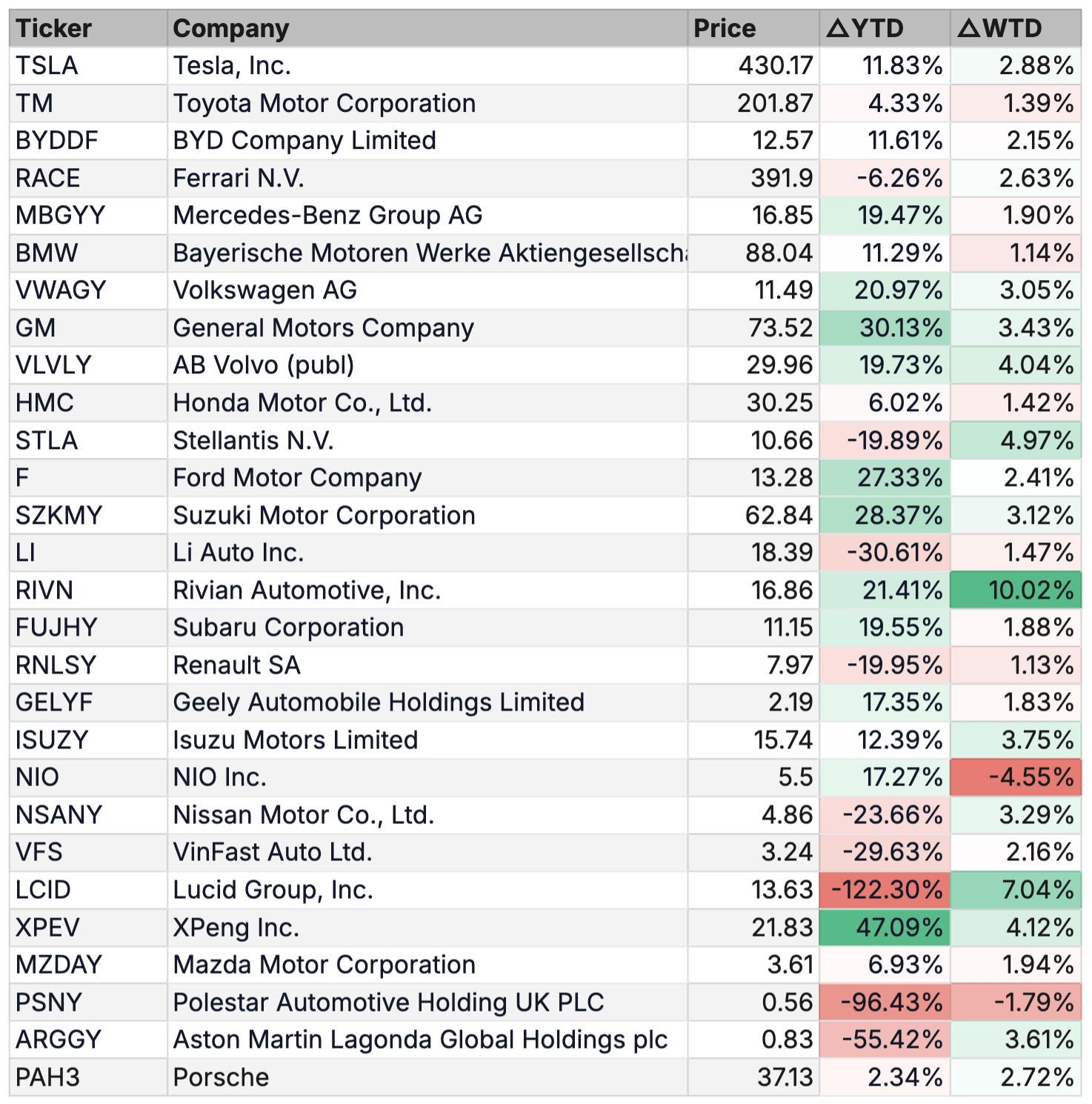

📈MARKET SNAPSHOT

This week’s key movers in the automotive stock market